Weelunk Contributor

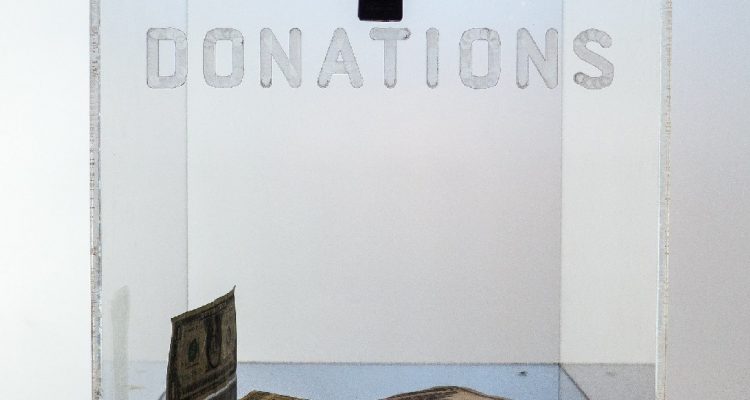

As we prepare our shopping list for Santa, does yours include making a donation to a worthwhile charity? The bells are ringing, and the red kettle can be seen at businesses around the Valley. The letters are coming in the mail.

“Your gift will help make a difference to ____ (fill in the blank).

Charitable requests occur all year long, and each year they seem to somehow multiply, and now during the holidays you may even seem overwhelmed by requests. And at every charity event, fundraiser, steak fry, or kids’ tag day you may hear the words, “Please help us…It’s a tax write-off!”

But is it?

Let’s be clear: Only donations to eligible organizations are tax-deductible. You didn’t think that Uncle Sam would just let you reduce your taxes for donations to anyone, did you?

There are rules and a 75,000-word tax code that we have to follow. Generally, these eligible organizations are 501(c)(3) entities. There is a searchable tool available on IRS.gov Select Check that lists most organizations that are eligible to receive deductible contributions. In addition, churches, temples, and government agencies are eligible to receive donations even if they are not listed in the tool’s database.

For individuals, only taxpayers who itemize their deductions on Form 1040 Schedule A can claim deductions for charitable contributions.

This deduction is not available to individuals who choose the standard deduction. Donors must get a written acknowledgement from the charity for all gifts worth $250 or more. It must include a description of the items contributed and include a statement declaring that “no goods or services were received” on your receipt or documentation. See IRS Pub 526 for details on the many charity documentation rules.

Inquire of your favorite, local Mountain State charity and see if they have any Neighborhood Investment Program (NIP) Credits available. Donations of a minimum of $500 will be eligible to reduce their West Virginia tax liability by 50 percent of the donated amount. Check out participating charities at WV NIP. These NIP credits are great tax-savings deals. You receive a potential federal tax savings, a West Virginia tax savings, and you help out a local worthy cause.

Continue to be generous Ohio Valley – it is one of your most endearing qualities. Philanthropy changes and improves culture; just document your generosity properly.

Happy Holidays to all!

feature photo by Don BeBold CC BY 2.0